Beating your competition in e-commerce with Dynamic Pricing

.png)

Introduction

In this blogpost we will deepdive together into dynamic pricing, and figure out how and why this became a game-changing strategy in the world of e-commerce.

We’ll go over the key characteristics of dynamic pricing:

- The iterative modelling cycle

- Necessity of customer feedback

- Concept of burn-in time

Ever since we as a species evolved from apes, commerce in one form or another has been around. In our early hunger-gathering stages we roamed in small communities which exchanged surplus items or specialised tools. About ten thousand years ago some of our ancestors decided to build a more permanent residence and work the field. This resolute decision, probably infused by an averseness for walking, had a remarkable outcome: commerce became significantly more organised and dependable, leading to an expansion of variety in goods and services. With the introduction of the first coin - the Mesomotampian Shekel - about five thousand years ago, trade systems further standardised with price conformity as a side-effect. These trends were further boosted by the globalisation of trade and - more recently - the birth of the internet. The internet further revolutionised commerce to such an extent that we decided to put an ‘e’ in front of the word. At the time of writing this blogpost in 2023, the e-commerce market is worth a whopping 573 billion euros in Europe. Forecasts indicate user penetration will grow from 64.0% in 2023 to 69.5% by 2027.

Source: https://www.statista.com/outlook/dmo/ecommerce/europe

E-commerce opens doors

The reason why we invented a new word for ‘internet commerce’ is because it was revolutionary. E-commerce has expanded global reach, provided convenience and accessibility, reduced costs, enhanced product discovery, increased competition and market efficiency, facilitated faster transactions, and disrupted traditional industries. These factors have fundamentally transformed the way businesses operate and how people engage in commerce, leading to significant societal and economic impacts.

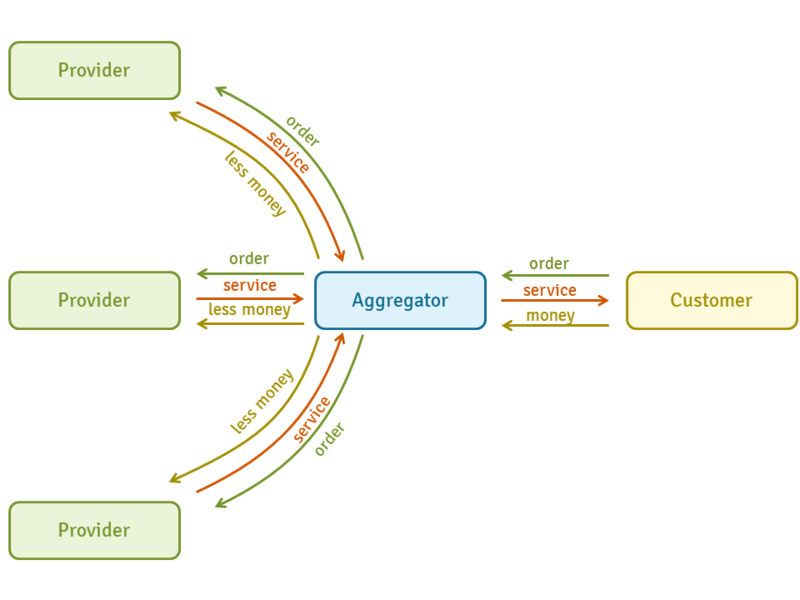

Catalysts for this fundamental change are aggregator markets. These e-commerce players aggregate products and services from different providers and in turn provide customers a platform to help them find the best deal faster and cheaper.

As a result, the market is under pressure and providers need to fight for their bone. In such a competitive environment, it is important for a provider to be attractive, by capitalising on brand, marketing your USPs (if applicable) and - most importantly - offer the best price.

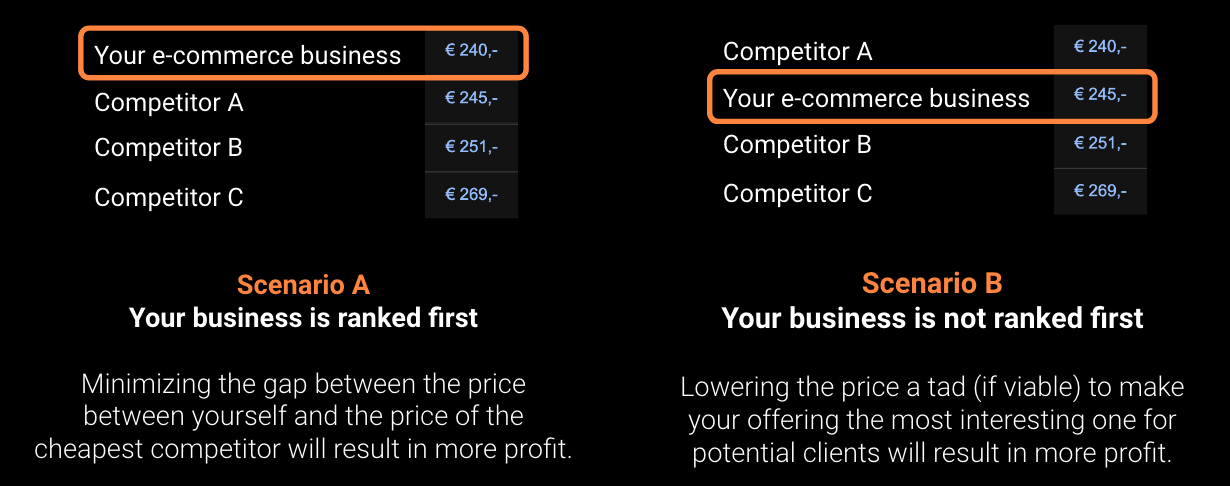

Consider this: you are a headphone provider and there’s a price-sensitive customer looking to buy a headphone via a web aggregator, caring only about price. Let’s now take a closer look at the two possible pricing scenarios.

The examples show that you as a provider benefit from having a market understanding because it enables you to optimally navigate within it, according to your business strategy. This business strategy could be to maximise profit, maximise revenue or gain market share.

But how do we create market understanding?

Creating market understanding with Dynamic Pricing

There are two naive ways to create market understanding:

- Collecting data via web aggregator or competitor scraping: This is often illegal, maintenance heavy and not completely reliable.

- Buying your data from the web aggregator: This data is not recent enough to understand the current market and is often expensive. Also, your competitors probably have this data too.

But we are not out of options! With Dynamic Pricing, there’s no need to interact with competition or your aggregator markets. As a result, you don’t run into legal issues while at the same time reliably building a competitive edge.

What is Dynamic Pricing?

Dynamic pricing, or DP in short, is a pricing method built on probabilistic statistics. You integrate a DP model within your pricing engine and it will generate different prices. These prices are not generated randomly but instead are chosen to - in first instance - explore the market and keep track of the prices your customers are buying. Over time, the DP model becomes increasingly certain about how the demand curve of the market looks and will shift its pricing behaviour towards prices that capitalise on the business strategy you chose (profit, revenue, market share, …).

For those who are still in doubt at this point; the word ‘dynamic’ refers to the dynamic nature with which prices are chosen. By default, there is never a fixed price a dynamic pricing model will adhere to as it is in the nature of the model to keep exploring the market to pick up on changing market conditions in case they occur by e.g. a change in competitors’ pricing strategies, competitors’ promotions or customer behaviour as a result of seasonality, holidays

There are multiple ways to deal with the dynamic pricing nature, and it is perfectly possible to keep your prices stable for the same customer, or for a reasonable amount of time. Think about your headphones e-commerce business for example: you might not like your customers to see a new price every time they refresh the page.

Characteristics of Dynamic Pricing

Dynamic Pricing starts by using historical data

Just like any supervised ML technique, Dynamic Pricing needs historical data to train to pick up on some market pattern as a consequence of the pricing strategy that was used before.

Dynamic Pricing learns iteratively, using customer feedback

After model initialization, you train your Dynamic Pricing model so that it learns how customers behave and what the market’s demand curves look like. It is imperative that the feedback of the customers based on the prices they get to see is captured. The flying wheel depicted below can be run through as often as necessary. Each cycle includes a feedback loop in which customer feedback is captured. In practice, once a day (overnight) is sufficient for many e-commerce use-cases, as in these cases the market does not change on an intraday level.

For the model to learn sufficiently fast, our experience indicates that we need

- At least 500 data points (offers sent) and at least 100 sales for near-static markets

- At least 100 data points per day (offers sent) and at least 20 sales for medium-static markets

- At least 250 data points per day (offers sent) and at least 50 sales for dynamic markets. This requirement easily runs into thousands of data points for crypto markets, the online advertising market or micro-trading financial markets. In these situations, you would typically train your DP model much more frequently.

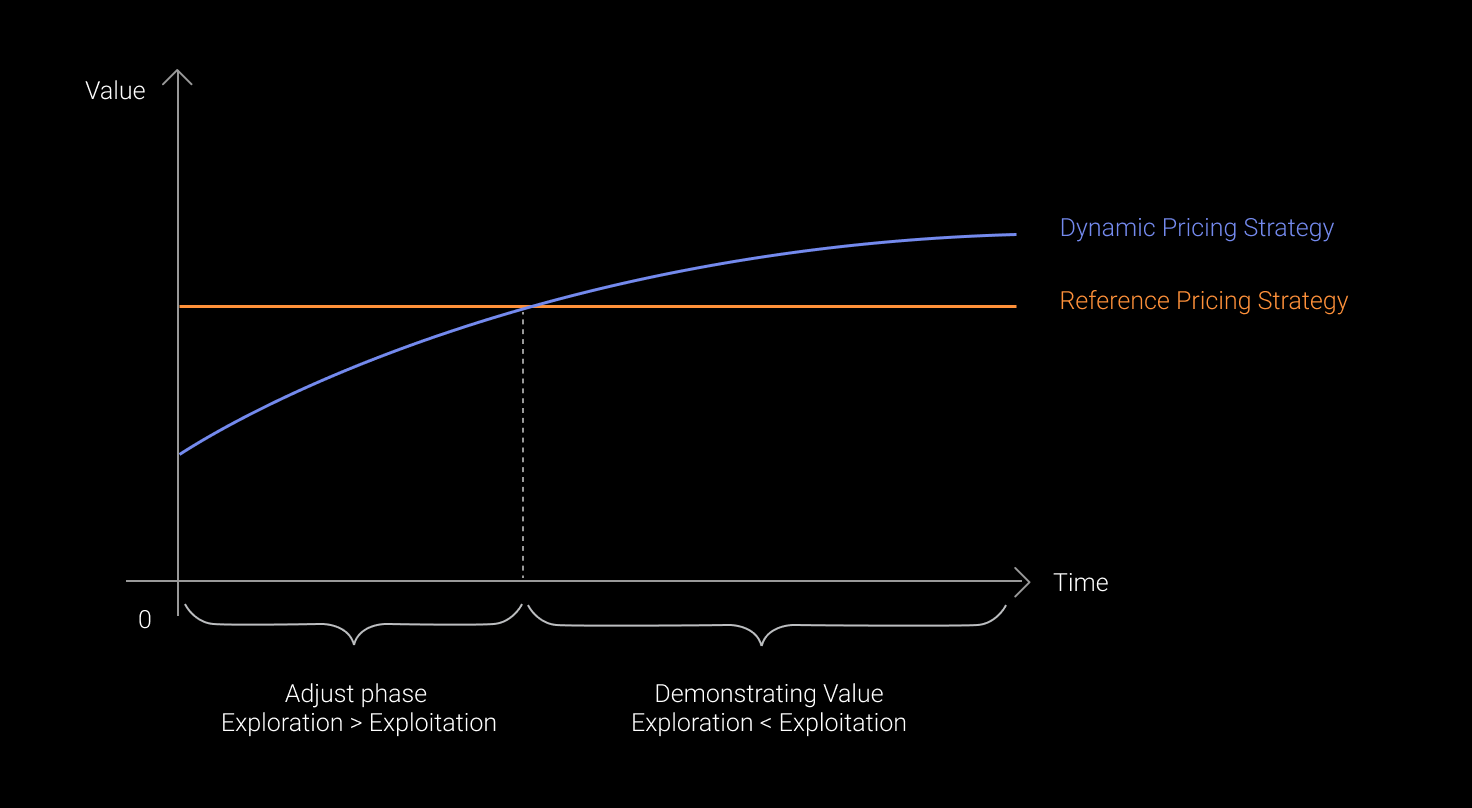

A Dynamic Pricing model gets better with time

In order for DP to reach its full potential, a certain level of patience is necessary. The graph below shows that one should expect a DP system to overtake a reference pricing strategy’s contribution to the business value only after a burn-in time. This burn-in time is the time the model needs to explore, before it can start to exploit the market.

This burn-in time is heavily influenced by how static the market is (static markets are easier to model than dynamic markets) and the amount of data.

Divide and conquer: a note on customer segmentation

Dynamic Pricing works best if all customers behave similarly, as that implies that the market is more predictable. That’s why we advocate to start by building customer understanding and splitting your customer based on groups that are similar (price-sensitive customers vs affluent customers that make their decisions based on quality, features or brand). Training one model for each of these distinct groups benefits your overall earnings greatly!

We know all about customer segmentation, so if you want to get started - hit us up!

In this blogpost, we explored the iterative modelling cycle that can be run as often as necessary and went over some rules of thumb on data volume and velocity. We also explained why it is necessary to go to production as soon as possible and involve customer feedback - and why we should have a bit of patience for our dynamic pricing model to get through the burn-in phase and start making an impact.

If you're ready to take your e-commerce business to new heights and unlock the power of dynamic pricing, whether it is in InsurTech, FinTech, to do price setting in the energy sector or get the most of your e-commerce products: our team is here to assist you. Contact us to get started on your journey to pricing success.